federal tax liens in georgia

The federal tax lien is created by Section 6321 which provides that. The Department is dedicated to enforcing the tax laws and strives to be.

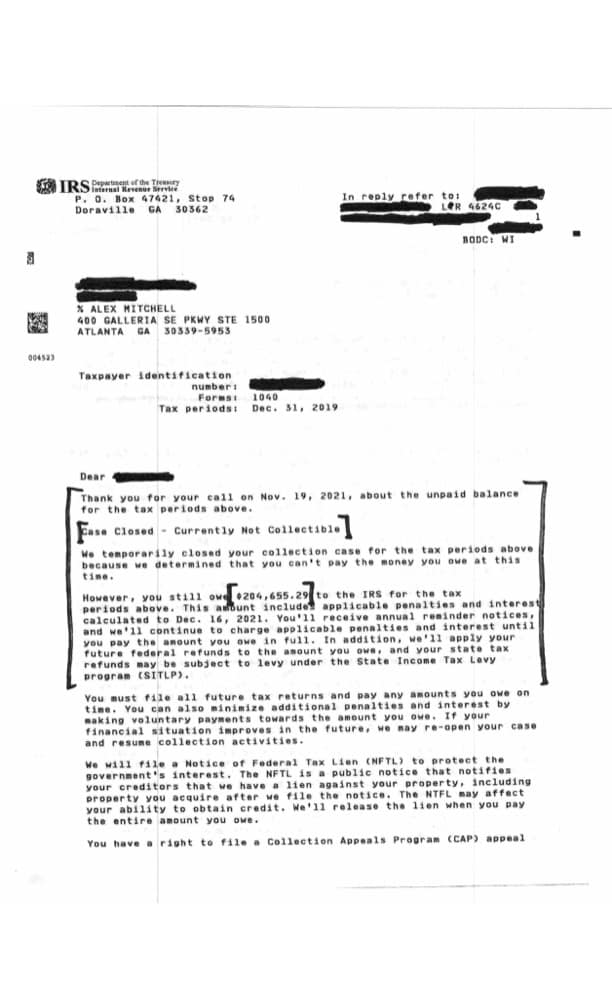

What Happens When You Have A Federal Tax Lien On A Property

Display County Index Data Good FromThru Dates.

. A federal tax lien exists after the IRS puts your balance due on the books. Ask us about what we do at our own tax practice to reach new clients with IRS issues. A tax lien also known as a FiFa from the Latin term Fieri Facias.

This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. 1 the 2019 Federal return and Georgia return were filed and the taxpayer did not account for the CARES Act change used 39 years etc. Georgia currently has 38775 tax liens available as of September 23.

In Georgia there are two types of tax lien sales. Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. Scenario 1- Assume the following.

Treasurys annual report the IRS filed 543604 tax lien notices in 2019. Pursuant to HB1582 the Authority is expanding the statewide uniform. According to the US.

Include neighboring counties in the search. A lien is a legal claim to secure a debt and may hamper the transfer of real or personal property. A federal tax lien is one that the federal government can use when you fail to pay a tax debt.

Understanding federal tax levies in Georgia Having an understanding of tax levies may help people protect their property and assets should they find themselves in arrears to the IRS. Within the state the. When an account becomes delinquent the Tax Commissioner may issue a tax lien against the property.

A subordination of a state tax lien lowers the priority of the Departments lien in favor of some other lien against the property. Federal tax liens are attached by the Internal Revenue Service IRS. If any person liable to pay any tax neglects or refused to pay the same after demand the amount including any interest.

The lien protects the governments interest in all your. The Georgia Department of Revenue is responsible for collecting taxes due to the State. The Department of Revenue may record tax liens also known as state tax.

For individuals enter last name first name Display Results From. That means if youre in. Pending Lien Search Search for pending liens issued by the Georgia Department of Revenue.

You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Tax liens offer many opportunities for you to earn above. Your Rights as a Taxpayer. The state tax lien remains in effect and will encumber the sale.

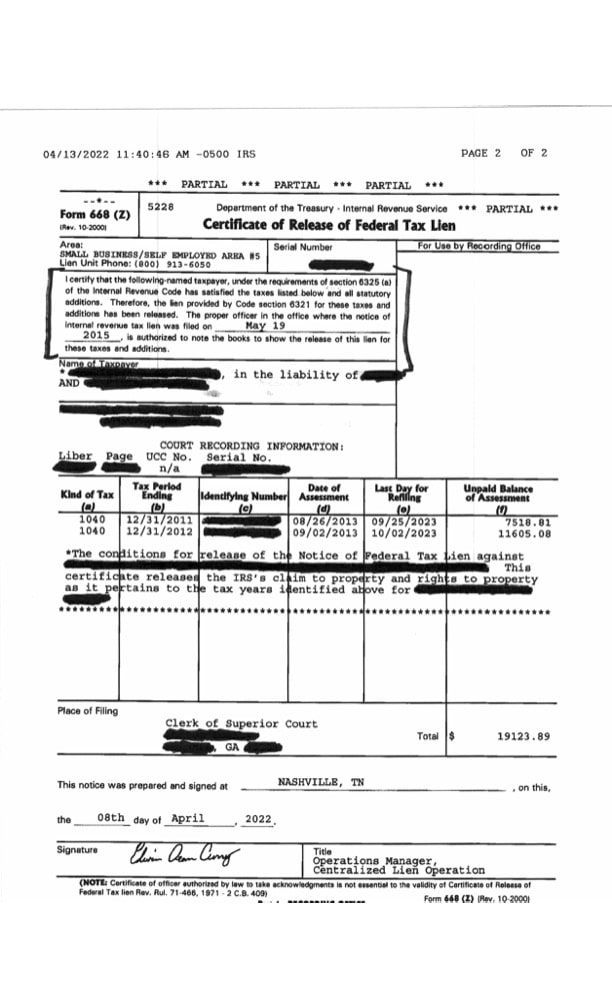

Notice Of Federal Tax Lien Certificate Of Discharge Taxfortress

How Long Does A Federal Tax Lien Last Heartland Tax Solutions

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

Tax Lien Foreclosure Definition

Pitfalls For The Inexperienced Georgia Tax Lien Investor Kim Bagwell Llc

Investing In Property Tax Liens

Irs Serves City Of Warner Robins A Federal Tax Lien For Nearly 800k Wgxa

Georgia Tax Sales Redeemable Tax Deeds Youtube

Irs Notice Federal Tax Lien Colonial Tax Consultants

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

How To Get Rid Of An Irs Tax Lien On Your Home Bankrate Com

Atlanta Tax Attorney Irs Tax Help Cumberland Law Group Llc

Federal State Tax Lien Removal Help Instant Tax Solutions

Why And How To Apply For A Federal Tax Lien Subordination

Examiner Publications Inc U 46 News Feed

Atlanta Tax Attorney Irs Tax Help Cumberland Law Group Llc

Purchasing A Tax Lien In Georgia Brian Douglas Law

How To Buy Tax Lien Certificates In Georgia For Big Profits