tax avoidance vs tax evasion australia

Reporting taxes that are not allowed legally. 61 02 8311 9993.

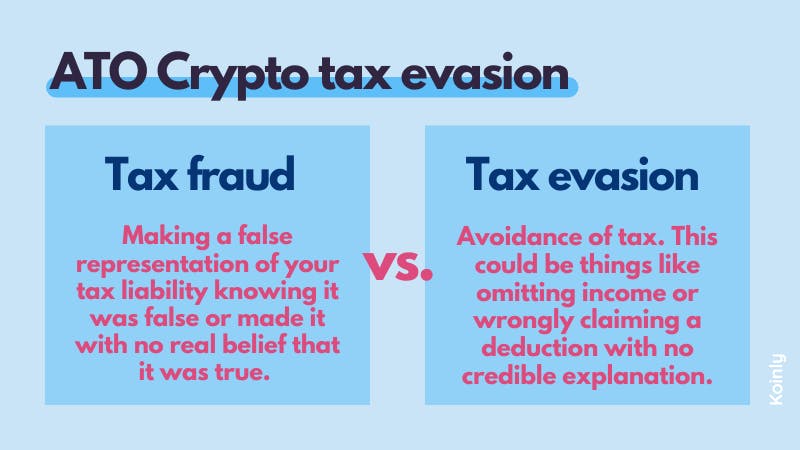

Ato Crypto Tax Evasion Risks And Penalties Koinly

Excerpt from Essay.

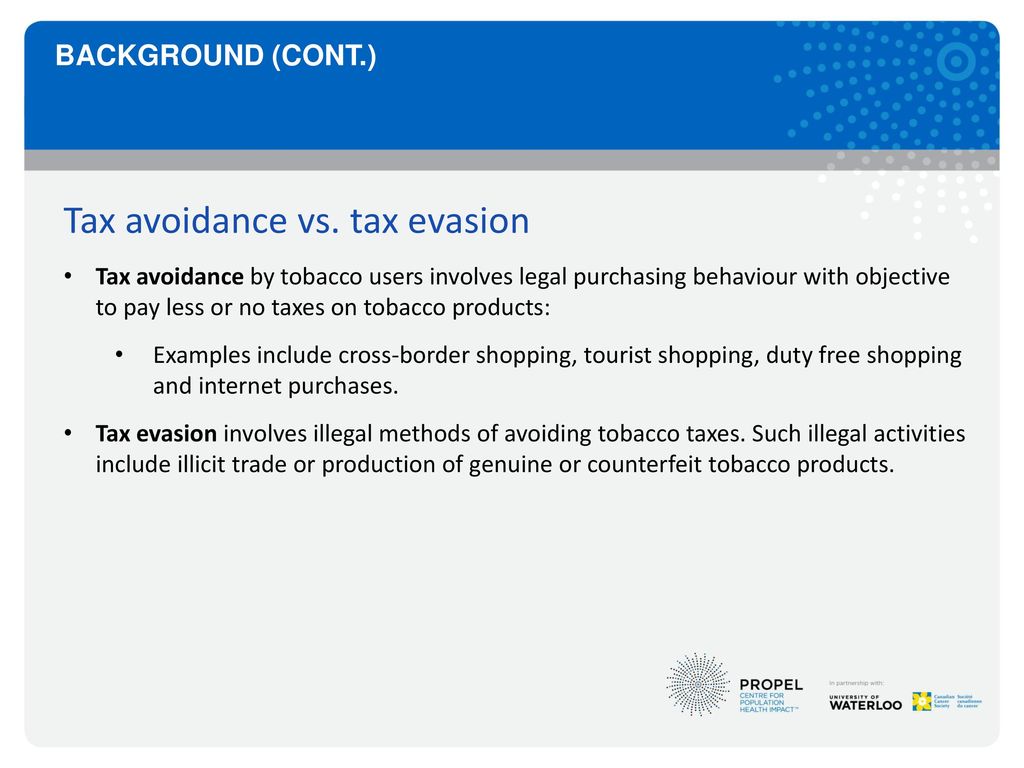

. And not reporting income. Whilst tax evasion is illegal tax avoidance is not. Tax avoidance is lawful and tax evasion is unlawful.

Australias legislative references to tax evasion do not refer to a criminal offence or even a category of criminal offences. The Australian Government funded the taskforce with 679 million over 4 years in 2016. The extra funding will continue to expand our risk assurance and compliance strategies.

Lord Templemans article in a 2001 Law Quarterly Review called Tax and the Taxpayer identified 3 approaches used to reduce tax burdens. Press question mark to learn the rest of the keyboard shortcuts. Tax non-compliance generally describes a range of activities that are unfavorable to a states tax system which include tax avoidance.

In this case the tax advisor guides hisher clients based on the law regarding tax avoidance and tax. 37 ATR 321 at 323 Gleeson CJ said Tax evasion involves using unlawful means to escape payment of tax. So above I started off talking about Tax Evasion vs Tax Avoidance.

TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments. The Australian government can prosecute tax evaders for committing offences under the Taxation Administration Act 1953 Cth. Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed.

Press J to jump to the feed. Minimizing your taxes is about managing and structuring your finances in a way that complies with the tax code while at the same time lowering your total income tax. Federal offences and tax evasion penalties.

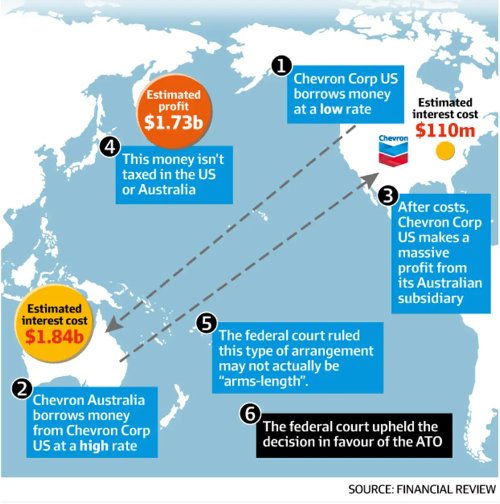

Tax evasion vs tax avoidance. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

Common tax avoidance arrangements. The Diverted Profits Tax will reinforce Australias position as having amongst the toughest laws in the world to combat corporate tax avoidance. Therefore tax avoidance means to reduce taxes by legal means whereas tax evasion refers to the criminal non-payment of tax liabilities.

The main objective of a tax advisor is to assist hisher clients avoid taxes as much as possible through within the confines of the law in order to avoid crossing the line into tax evasion. This short piece will also look at the Islamic view on this matter. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax.

A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. The Australian tax law is extensive.

While tax evasion is against the law minimizing your taxes is perfectly legal and often encouraged. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments. Australian media mogul Kerry Packer used the distinction as a complete defence when he told a parliamentary committee in 1991 he was.

Avoidance meant arranging your affairs so tax wasnt due. Tax avoidance is organizing your undertakings with the goal that you pay a minimal measure of tax due. Thus enabling the country to battle tax crimes and ensure the.

In the 201920 Federal Budget a further 1 billion extended the operation of the Tax Avoidance Taskforce to 202223. Tax evasion is lying on your personal tax structure or some other structure says Beverly Hills California-based tax. The first method is tax evasion and is a criminal offence.

Within the tax code there are provisions that allow eligible taxpayers. Some luminaries have 3 categories instead of 2. Tax avoidance vs tax evasion.

What is the main difference between tax evasion and tax avoidance. Tax evasion is illegal as it is the failure of a taxpayer to pay actual taxes that they owe to the authorities by deceit or by concealing the exact tax amount. Tax attorneys and accountants often try to reduce the tax liability of their clients by engaging numerous methods.

The distinction between tax evasion and tax avoidance to a great extent comes down to two components. Whereas tax evasion on the other hand is not a simple journey. TA 20211 Retail sale of illicit alcohol.

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Explainer The Difference Between Tax Avoidance And Evasion

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion And Tax Fraud And How An Experienced Canadian Tax Lawyer Can Help

Differences Between Tax Evasion Tax Avoidance And Tax Planning

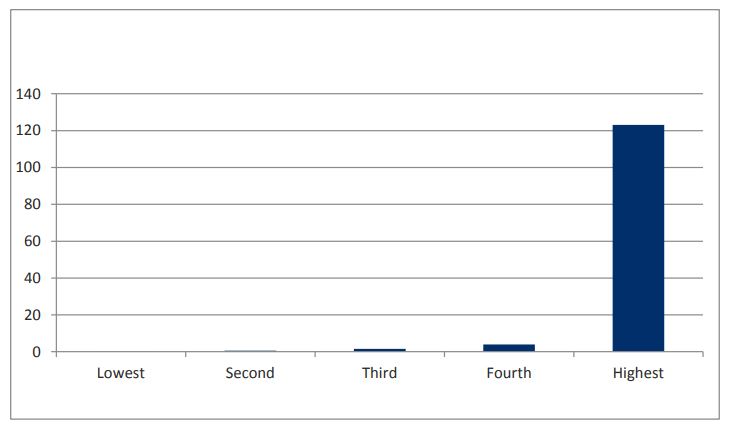

Tax Evasion The Budget Cost Prosper Australia

Ending Tax Avoidance Evasion And Money Laundering Through Private Trusts Acoss

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Chart The Global Cost Of Tax Avoidance Statista

Differences Between Tax Evasion Tax Avoidance And Tax Planning